One of the most significant challenges facing modern society is to balance the growing demand for power with the dwindling supply of fossil fuels. Meeting this challenge will require more efficient use of existing resources, improving the cost and energy efficiency of existing processes, developing new processes and technologies, and exploring alternative sources of power.

The growing environmental impact of fossil fuels and government initiatives for clean energy are driving the global shift to alternative energy. With CO2 levels rising from 277 ppm in 1750 to 414 ppm in 2022, the need for alternative energy sources is urgent.

Fossil fuels account for nearly 89% of global CO2 emissions, and their adverse effects on health and the ecosystem are pushing nations to seek cleaner options. The rise of electric vehicles and industrialization in developing economies further fuels demand for alternative energy.

These sources not only offer affordable electricity but also create jobs and reduce reliance on fossil fuels like natural gas and coal. Large corporations, including Amazon, Google, and Microsoft, are increasing their demand for alternative energy to power data centers.

With the potential to reduce carbon output and improve public health, alternative energy is poised to drive growth in the global energy market.

The Alternative Energy Market size was valued at $943.39 Billion in 2023 and the total Alternative Energy revenue is expected to grow at a CAGR of 11.85% from 2024 to 2030, reaching nearly $2066.08 Billion.

Freedom Holdings, Inc. (OTC: FHLD), through The TAG GRID, provides integrated solutions in financing, procurement, and installation, positioning the company to support the growing demand for alternative energy and lead the transition to a more sustainable future.

Meeting the Growing Demand for Clean, Sustainable Energy

The global energy market faces a critical challenge: balancing the increasing demand for power with the environmental and health impacts of fossil fuels. With fossil fuels responsible for nearly 89% of global CO2 emissions, the need for cleaner energy solutions is more urgent than ever. Traditional energy sources are becoming insufficient, and governments, industries, and consumers are seeking sustainable, affordable alternatives. The shift to alternative energy is essential to mitigate climate change, reduce pollution, and meet the growing power demands, creating a significant market opportunity for companies providing innovative energy solutions.

Freedom Holdings’ TAG GRID: Powering the Future with Sustainable Solutions

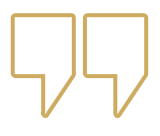

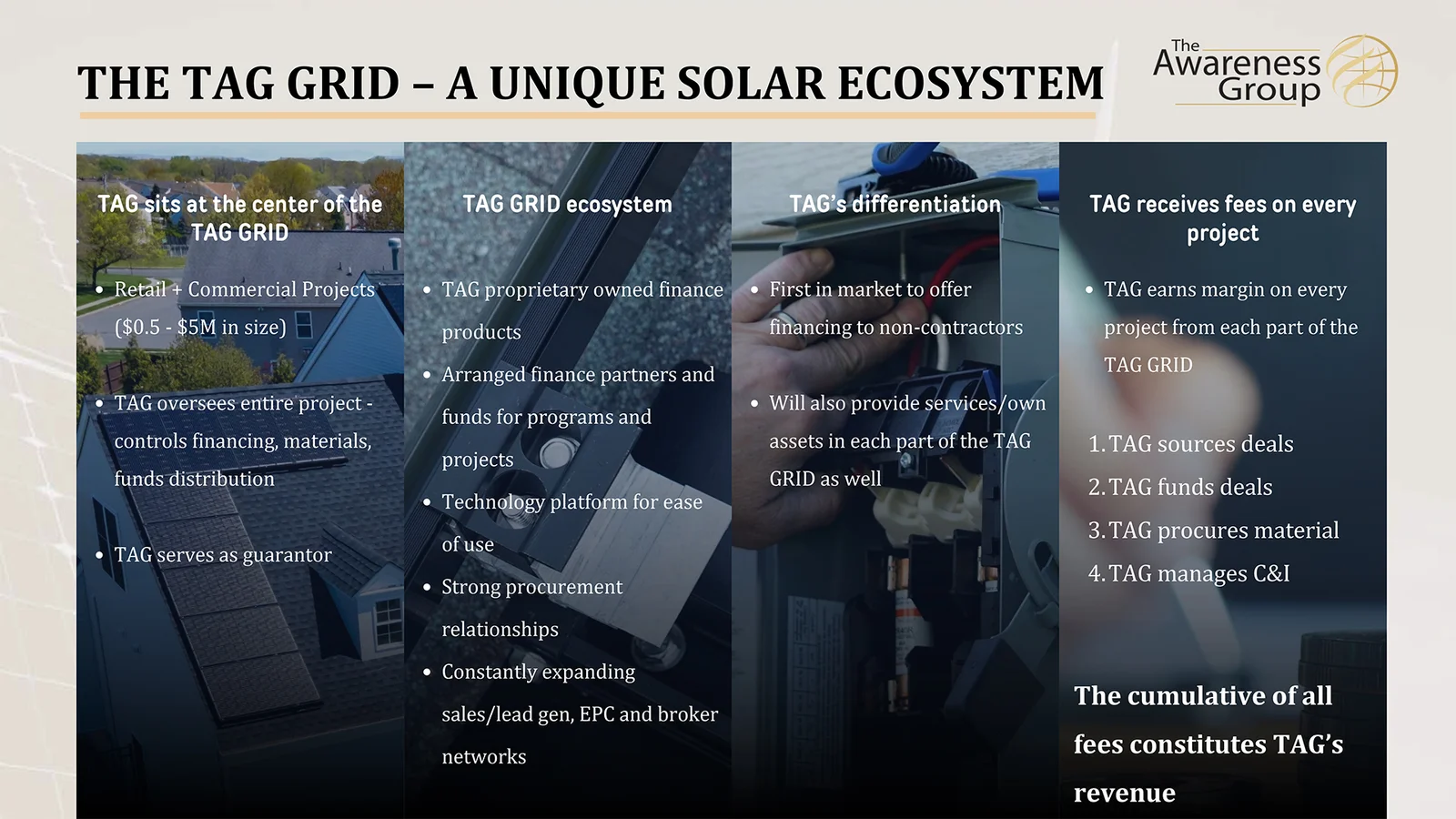

Freedom Holdings, Inc. (OTC: FHLD) addresses the growing demand for clean energy through The TAG GRID, an all-in-one platform offering financing, procurement, and installation services for alternative energy solutions. By integrating these services, TAG GRID simplifies the transition to sustainable energy, making it accessible and affordable. The platform supports both residential and commercial solar projects, empowering businesses and homeowners to adopt solar energy without the barriers of traditional financing. With a focus on reducing reliance on fossil fuels, TAG GRID plays a pivotal role in driving the shift to cleaner, more sustainable power.

Expanding Market Potential in Alternative Energy

The global alternative energy market is valued at >$943.39 billion in 2023 and is projected to grow at a CAGR of 11.85%, reaching $2.06 trillion by 2030. The U.S. residential solar market alone is estimated at $181 billion with only 5% market penetration, while the U.S. commercial solar market is valued at $142 billion with less than 2% penetration. Additionally, the U.S. carbon credits market stands at $20 billion, with less than 1% market penetration. As demand for clean energy solutions and carbon offset initiatives rise, TAG GRID is well-positioned to capitalize on this expansive market, offering investors* substantial growth opportunities in a rapidly evolving sector.

*See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, the risks associated with forward looking statements, the need to seek the advice of a professional investment advisor before investing, and more.

Greetings Investors!*

Freedom Holdings, Inc. (OTC: FHLD) presents an investment opportunity in the growing alternative energy sector. As global energy demand rises and environmental concerns intensify, the shift toward sustainable energy solutions is increasingly important. The TAG GRID platform is positioned to meet this demand with integrated solutions for financing, procurement, and installation of solar energy projects.

The U.S. residential solar market is projected to reach $181 billion, while the U.S. commercial solar market is valued at $142 billion, both with significant room for growth. TAG GRID is strategically positioned to capitalize on these expanding markets.

As Freedom Holdings continues to expand its offerings and reach, investors* are invited to participate in the growing demand for alternative energy, while also pursuing financial returns.

Thank you for considering Freedom Holdings, Inc. as part of the growing shift toward sustainable energy.

*See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, the risks associated with forward looking statements, the need to seek the advice of a professional investment advisor before investing, and more.

“In the next half decade, the long-term tax incentives and manufacturing provisions in the IRA provide the market certainty needed to boost expected solar deployment by 38% compared to pre-IRA projections.”

By Solar Energy Industry Association

Top Reasons to Have FHLD on Your Radar*

01

Expanding Market Opportunity: The global alternative energy market is projected to reach $2.06 trillion by 2030, with substantial growth in both residential and commercial solar sectors. The U.S. residential solar market is valued at $181 billion with only 5% market penetration, while the commercial solar market is valued at $142 billion with less than 2% penetration. Additionally, the U.S. carbon credits market stands at $20 billion with under 1% penetration. These figures highlight the vast market potential, and TAG GRID is well-positioned to capitalize on this growing demand for clean, sustainable energy solutions.

02

TAG GRID Platform: TAG GRID offers an all-in-one solution for financing, procurement, and installation of solar projects. This integrated approach simplifies the transition to solar energy for businesses and homeowners, positioning the platform to play a key role in the alternative energy space.

03

Rising Demand for Clean Energy: With growing government initiatives and the increasing environmental impact of fossil fuels, the demand for alternative energy solutions is at an all-time high, creating a favorable market environment for Freedom Holdings.

04

Highly Attractive Financial Return Potential: With substantial growth projected in the alternative energy market, Freedom Holdings offers investors the opportunity for strong financial returns as the company captures a significant share of this expanding sector.

05

Highly Attractive Financial Return Potential: With substantial growth projected in the alternative energy market, Freedom Holdings offers investors the opportunity for strong financial returns as the company captures a significant share of this expanding sector.

06

Commitment to Sustainable Energy: Freedom Holdings is committed to helping businesses and individuals transition to clean, affordable energy, contributing to a sustainable future and addressing global environmental challenges.

07

Strategic Positioning for Growth: Freedom Holdings is strategically positioned to expand its presence in the rapidly evolving alternative energy sector, with a scalable business model designed to meet increasing market demand.

08

Proven Leadership and Vision: Led by a team with deep expertise in alternative energy, Freedom Holdings continues to innovate and expand, making it a strong player in the clean energy market with the potential for continued success.

09

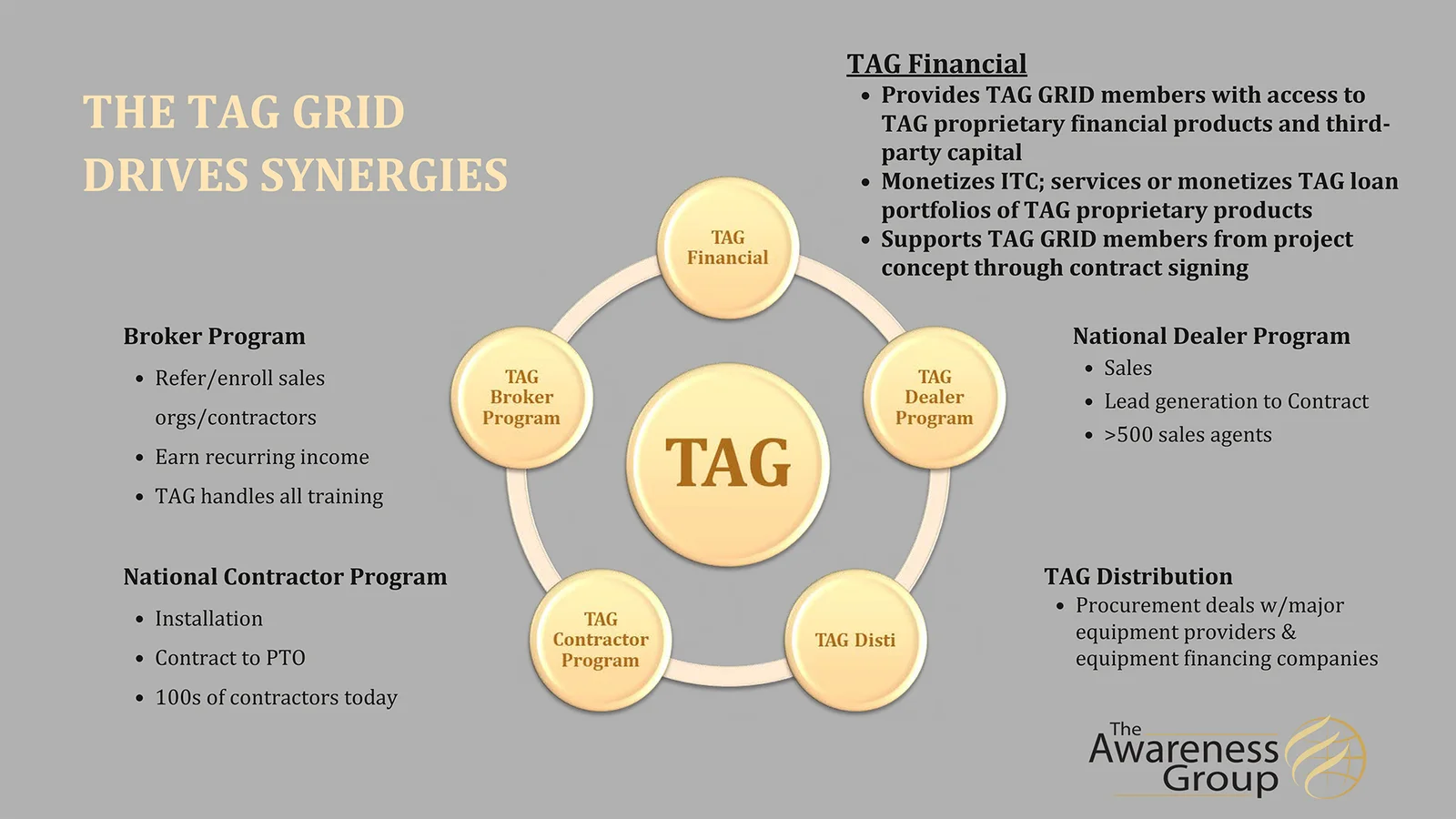

Strategic Acquisitions to Accelerate Growth: Freedom Holdings has made key acquisitions to drive growth, including REPM Corp. for commercial solar solutions, Southwest Financial to enhance financing, CandelaCoin for blockchain-driven solar energy, Rexinft to streamline carbon credit monetization, and Manicorn Productions for expanded lead generation. These acquisitions strengthen market position, expand reach, and create new revenue streams.

10

Expanding Technological Innovation: Freedom Holdings is leveraging cutting-edge technologies to enhance its solar solutions and streamline financing processes, ensuring competitive differentiation in the growing clean energy market.

*See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, the risks associated with forward looking statements, the need to seek the advice of a professional investment advisor before investing, and more.

Company Overview

Empowering the Future of Energy: Freedom Holdings, Inc. (OTC: FHLD) Leading the Charge in Alternative Energy Revolution

At The Awareness Group (TAG), leadership in the alternative energy revolution is the core mission. Fueled by innovation, TAG is setting new benchmarks with the TAG GRID, a groundbreaking national platform offering a unique, differentiated program of solar services and financing solutions for both commercial and residential projects.

By managing projects from concept to installation, TAG ensures world-class service, acting as the guarantor for all projects and enhancing satisfaction for both service providers and end customers. TAG’s growth engine, TAG Financial, includes TAG Financial Services (TFS) for managing the front-end process and TAG Capital, the in-house fund management division that funds proprietary lending products and maximizes the value of loan portfolios and investment tax credits (ITCs).

Strategic acquisitions accelerate expansion, driving revenue, offering unique solutions, and solidifying TAG’s role in the alternative energy landscape. With these efforts, TAG is delivering exceptional value for customers, employees, partners, and investors, driving the future of energy today.

Mission

At TAG – Freedom Holdings, TAG’s mission is to empower businesses with innovative energy management solutions. TAG strives to promote sustainability and reduce energy costs through cutting-edge technologies and practices.

GROWTH STRATEGY

Growth strategy is centered around expanding The TAG GRID by:

↬ Driving organic growth through our proprietary growth programs;

↬ Realizing synergies across the portfolio;

↬ Acquiring complementary alternative energy assets/companies to fortify our national footprint.

WHY INVEST IN TAG?

↬ Massive, Underpenetrated Market w/Favorable Regulatory Environment

↬ The TAG GRID Drives Organic and In-organic Growth

↬ Disruptive Assets Provides Optionality and Differentiation

↬ Highly Attractive Financial Return Potential

EXPERIENCED TEAM BEHIND THE TAG GRID

Pablo Diaz

CEO, Chairman of the Board

Pablo Diaz was senior executive at two successful publicly traded companies. Since 2011, he has been party to over 14,000 alternative energy installations and has structured over $400 million dollars for alternative energy projects throughout the U.S. and Canada. A recognized industry expert, he has been featured in over 30 publications and media outlets, including the Washington post, Houston Chronicle, and Yahoo Finance. In 2020, Pablo was awarded the Top Dynamic CEO by CEO Magazine.

Nadia Conn

CFO, Board Secretary

Nadia Conn serves as Chief Financial Officer and strategic business partner for TAG, bringing over 30 years experience leading the financial health, business strategy, accounting operations, and internal controls through a 360-degree business perspective. She previously served as CFO of several renewable energy companies, Jacobs Engineering. She has a masters in economics from Tajikistan University and a B.S. in Accounting from Western International University.

Frank Moreno

Chief Marketing Officer

Frank Moreno has a history of driving growth for energy sector businesses through the creation and delivery of unique, creative brand strategies, enhancing customer acquisition, and market position. Frank helps CEOs develop and implement strategic marketing and revenue growth initiatives. He brings an insights-based approach to digging into complex growth challenges, uncovering market opportunities, crafting growth- oriented strategic plans, and turning them into reality. He focuses on outcomes and on building impactful growth solutions with lasting value.

Brooks Holcomb

Board Member

Brooks Holcomb is a practicing attorney specializing in business law. He has been published multiple times by the American Bar Association and the State Bar of Arizona, and also has been recognized as a top 50 pro bono attorney, and Guardian ad Litem Attorney of the Year. Mr. Holcomb owns several fine dining restaurants, has interests in multiple recognized successful businesses in Arizona and is a founder and General Counsel for a national health based restaurant chain. He has served on multiple boards, including the Foundation for Burns and Trauma, Inc. and the Joyner-Walker Foundation, Inc. He serves as a Colombian Diplomat to the United Nations and is a United Nations Special Agent.

Marco Rubin

Board Member

Marco Rubin specializes in strengthening existing foundations within the professional investment community including venture capital, institutional investors, investment bankers, private equity and corporate venture groups. Also builds upon his existing track record with emerging technology investment operations at the local, state and national levels either through partnerships or new entity formations. Marco possesses unique experience dealing with federal venturing operations as well as leading edge research institutions. Examples include the National Science Foundation and the MITRE Corporation.

In Summary…

TAG – Freedom Holdings is positioned at the forefront of the alternative energy industry, offering innovative solutions that empower businesses to manage energy efficiently. The company’s flagship platform, TAG GRID, provides integrated solar services and financing solutions, simplifying the transition to sustainable energy for both residential and commercial projects.

With a focus on cutting-edge technologies, TAG – Freedom Holdings strives to promote sustainability and reduce energy costs, helping businesses improve their operational efficiency. Strategic acquisitions further enhance the company’s capabilities, ensuring continued growth and innovation.

The rapidly expanding alternative energy market presents significant opportunities, and TAG – Freedom Holdings is poised to capitalize on this demand, delivering exceptional value to its customers, employees, and investors.

TAG – Freedom Holdings is committed to shaping the future of energy with sustainable, cost-effective solutions that benefit businesses and the environment.

*See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, the risks associated with forward looking statements, the need to seek the advice of a professional investment advisor before investing, and more.

Source

i – https://www.diamond.ac.uk/industry/Case-Studies/Energy-Case-Studies.html

ii – https://www.maximizemarketresearch.com/market-report/alternative-energy

iii – https://ir.awarenessgroup.llc/assets/uploads/2025/02/The-Awareness-Group-FHLD-Investor-Presentation-Oct-2024-compressed.pdf

Images Credits

https://www.freepik.com/free-photo/solar-cell-farm-power-station-alternative-energy-from-sun_2887669.htm

https://www.freepik.com/free-photo/alternative-energy-ecological-concept_8896441.htm

https://www.freepik.com/free-photo/aerial-view-private-house-with-solar-panels-roof_10292215.htm

https://www.freepik.com/free-photo/solar-cell-farm-power-station-alternative-energy-from-sun_2887671.htm

https://www.freepik.com/free-photo/person-near-alternative-energy-plant_20735167.htm

Disclaimer

PLEASE NOTE WELL: We, Private Parties are not registered as an Investment Advisor in any jurisdiction whatsoever.

This is for informational purposes only. No one has not been compensated for this this profile (FHLD). Though we do intend to pay Social Media Influencers to post this landing page – website for awareness only.

Stocks profiled on this website are and is for informational purposes only. Information on these pages contains forward – looking statements that involve risk and uncertainties. The purpose of these profiles is to make investors aware of these companies and should not in any way come across as a recommendation to buy or sell in these securities. Investing in stocks involves risk. You should consult a qualified financial advisor or broker before making any investment decisions. All profiles are based on information that is available to the public. Past performance of stocks profiled on this web site is not a guarantee as to future performance. The information contained herein should not be considered to be all-inclusive and is not guaranteed by We to be free from misstatements or errors.

We do not give price targets in any of our written or recorded material.

Please do your own research and make your own investment decisions. Always remember that We is not an analyst and we do not employ or contract any analysts. Investing in securities such as the ones mentioned on our website, in email, or consulted for are for high-risk tolerant individuals only and not the general public.

Whether you are an experienced penny stocks investor or not, you should always consult with a licensed penny stock broker before buying or selling any securities that We profiles, mentions, in email updates, consults for or interviews. If shares are restricted, We may sell them when they are registered. If the penny stocks shares are freely transferable, We intends to sell them. At no time will any We employees or affiliates undertake any activity that could be regarded in any fashion as improper or illegal. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

Many of the companies communicated in our emails or website are developmental stage companies with little or no operating or trading history. The information contained in our alerts should be viewed as commercial advertisement and is not intended to be investment opinion. The report is not provided to any particular individual with a view toward their investment circumstances. The information contained in our alerts is not an offer to buy or sell securities. We distribute opinions, comments and information free of charge to individuals who wish to receive them. Our advertisements and website have been prepared for informational purposes only and are not intended to be used as a complete source of information on any particular company. An individual should never invest in the securities of any of the companies profiles based solely on information contained in our report. Individuals should assume that all information contained in the alerts about profiled companies is not trust worthy unless verified by their own independent research. Any individual who chooses to invest in any securities should do so with caution. Investing in securities is speculative and carries a high degree of risk; you may lose some of all of the money that is invested. Always research your own investments and consult with a registered investment advisor or licensed stockbroker before investing. The profiles are a service of We, a marketing and advertising firm that may have been compensated. All direct and third party compensation received will be disclosed within each individual alert in accordance with section 17(b) of the nineteen thirty three Securities Act. Any compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled companies.

We distributes its Electronic Content and provides other promotional services with the intention of helping the “featured company and or companies” to create public awareness of their current business and future objectives, as well as to aid in the development of a liquid trading market for the “featured company’s” securities, although there is no intent to make a market or facilitate, in any manner, the purchase and sale of the “featured company and or companies” securities. Electronic Content refers to all Electronic Material distributed and created, and/or edited by We and includes, but is not limited to Emails, Newsletters, any Social Media content such as Facebook and Twitter, Blog Postings, Video Content, Corporate Profiles, Corporate Videos, Analyst Reports, PowerPoint Presentations, CEO Video Interviews, Press releases, Banners, Images, Google Advertising, Microsoft Ad center Advertising, and/or web based discussion board postings of any kind.

Although there is no guarantee that a liquid market will develop in the “featured company’s” securities, in the event that an active market does develop, investors should be aware that existing shareholders (controlling, or non-controlling) will be motivated to sell their shares potentially creating an oversupply scenario, under which the price of the shares is likely to experience sudden declines. At the same time, if the existing shareholder base holds shares tightly, and an active trading market develops, this may result in sudden increases in the price of the stock due to a potential undersupply scenario. In any case, there can be no guarantee that the price of the stock will reflect the fundamental value of the “featured company and or companies”. We disclaims all knowledge of the “featured company and/or companies” shareholder base, capacity for liquidity, or other means or methods of enhancing public awareness.

Forward Looking Statements

All forward-looking statements in this press release are expressly qualified by such cautionary statements and by reference to the underlying assumptions. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell penny stocks securities of the penny stocks companies profiled herein and any decision to invest in any such penny stocks company or other financial decisions should not be made based upon the information provide herein. Instead We strongly urges you to conduct a complete due diligence of the respective penny stocks companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. We does not offer such advice or analysis, and We urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth penny stocks securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

We may feature or profile a company periodically (usually for life of contract) and may remove that profile at it’s own discretion. Profiles and disclosures for those profiles may or may not remain visible on We website.

We website may contain links to related websites including, but not limited to, stock charts, stock quotes, SEC data, NASD data, etc. We are not responsible for the content of or the privacy practices used by these sites. We encourage our readers to review all public filings by companies at the SEC’s EDGAR page located at SEC.gov. This published information on how to invest carefully at NASD.com.

PLEASE READ – I am a Private party engageing in the marketing and advertising for NO monetary compensation and hold NO stock in my or our names at this giving time. All content in our releases is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. These sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by us or an offer or solicitation to buy or sell any security. Neither the owner nor any of its members, officers, directors, contractors or employees is licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters . Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed in our releases. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed in a release or on our website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk.

Notice of Stock Price Movements and Volatility Viewers of this newsletter should understand that trading activity and stock prices in many if not all cases tend to increase during the advertisement campaigns of the profiled companies and in many if not all cases tend to decrease thereafter. This tends to create above average volatility and price movements in the profiled company during the advertisement campaign that viewers should take into consideration at all times. Campaigns vary in length, and many are for short periods of time, typically less than a week. Some of the content in this release contains forward-looking information within the meaning of Section 27 A of the Securities Act of 1 993 and Section 21 E of the Securities Exchange Act of 1 934 including statements regarding expected continual growth of the profiled company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1 995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned in this release. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled is provided from public sources which we believe to be reliable but is not guaranteed by us as being accurate. Further specific financial information, filings and disclosures as well as general investor information about the profiled company, advice to investors and other investor resources are available at the Securities and Exchange Commission (“SEC”) website www.sec.gov and the Financial Industry Regulatory Authority (“FINRA”) website at www.finra.org. Any investment should be made only after consulting with a qualified investment advisor and reviewing the publicly available financial statement and other information about the company profiled and verifying that the investment is appropriate and suitable.

We nor anyone makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained in this release or on our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and this Network has no obligation to update any of the information provided. Its owners, officers, directors, contractors and employees are not responsible for errors and omissions.

From time to time certain content in our releases or website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our releases and website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled in our release or on our website may not have approved certain or any statements within the website. We encourage all viewers to supplement the information obtained from this release and our website with independent research and other professional advice. The content in this release is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data.

This release may provide hyperlinks to third party websites or access to third party content. Its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does it control, endorse, or guarantee any content found in such sites. By accessing, viewing, or using the website or communications originating from this release, you agree that we its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that we and its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only.

We are and use third parties to awareness and disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. You agree to its operators, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur arising out of the use of our website or the information in our press releases, profiles and opinions. You agree that use of our website is at your sole risk. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the SEC. The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or then FINRA at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/investors/index.htm.

(Last updated: April 1, 2025)